Overspending can cause serious problems for a small business. Too much cash going out and not enough cash coming in can spell disaster for a business’s cash flow. And, in the current climate, keeping tabs on overspending in your company has become more important than ever. Because no one quite knows what’s around the corner…

The coronavirus pandemic has heralded changes in consumer spending habits and is impacting some sectors like hospitality and travel at an alarming rate. It’s clear that businesses need to take control of overspending now, to deal with lumpy cash flow and the uncertainty of the months ahead.

Common areas in which businesses are overspending

There are some common reasons businesses overspend, including not sufficiently planning ahead, overstocking inventory, and not setting (or sticking to!) budgets across different activities and departments. Can you honestly say you have an idea if your HR, operations or marketing team are over or under budget this month? What about the last three months? This is the detail that will help you control overspending and keep your cash flow healthy.

The reasons for overspending will vary from business to business, but you may recognise one of these common ones…

Hiring too many staff too quickly

If you want to grow your business then, of course, you need to hire new staff. But expanding too quickly has been the downfall of many businesses. Don’t forget that there are more expenses associated with hiring staff than their salary. You’ll also have to take into account the cost of recruitment, training them, benefits, National Insurance, pension, office space and equipment. According to The Undercover Recruiter, the cost of hiring someone on a £27,000 salary is close to £50,000. Multiply that by five or ten new hires and you can see why businesses might soon run into trouble.

Data storage and management

Every business needs a way of securely storing data. But are you using the right service for your needs? If you’ve signed up to a bells-and-whistles platform but only using one feature every month, then you could be overpaying for services you don’t need. Take a good look at how you’re storing your data and shop around to see if there are any more affordable options for you.

Other tools and subscriptions

This applies to other tools, too. There are so many different pieces of software out there that it can be tempting to sign up for everything promising to help your business achieve more, for less. But how many of them do you actually need? If you’re not careful, you could end up with too many subscriptions, or with duplicates across departments. It’s a good idea to keep a live list of every software subscription in the business, and audit it regularly to see if every tool is still in use, how it’s benefitting your business, and whether it could be swapped for a cheaper alternative or removed altogether.

Marketing and advertising

It’s easy to get caught up in marketing and advertising, creating big, impactful campaigns that will get your brand noticed. Getting noticed is a great thing, of course – but not at the expense of your company. You should aim for an efficient marketing spend, putting your money into the right areas that will see the biggest return on investment. Whether you go it alone or partner with an agency to handle your marketing and advertising is something you’ll have to weigh up carefully to ensure you’re not overextending your budget.

Office space

Are you spending thousands of pounds a month on a big office space that sits empty half the week because you’ve moved to a hybrid work model? Consider your office size, location and facilities. Could you downscale to a smaller space, or use a coworking space instead? Or could you move to a different part of town rather than being based in the city centre? Maybe you could even move to a remote-first model and get rid of your office space completely, instead just hiring out meeting rooms when you need to get in front of clients in-person.

Why do businesses overspend?

Again, the reasons behind your overspending are as unique as your business – but there are several common reasons for companies to stretch their budget beyond their means. These include:

A lack of planning. If you don’t budget, then it’s easier to fall into the red – and if you don’t do any research to find out how much you should spend on different areas of your business, it’s more likely that you’ll accept any costs quoted.

Not negotiating. It never hurts to negotiate on prices – what’s the worst that can happen? If you say yes to the first price quoted, then you’re almost certainly overspending.

No analytics. If you don’t regularly audit your incomings and outgoings, then you’ll continue to do the same as you’ve always done – overspending.

How to spot overspending

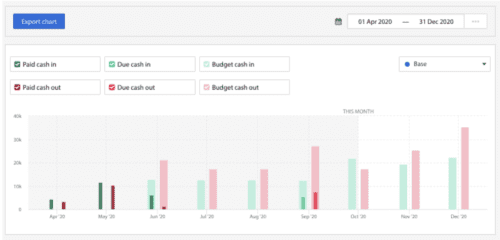

The key to spotting overspending is to use an analytics and reporting tool to give you better insight. Accounting software such as Xero and QuickBooks offer some insight, however to truly understand where your business is overspending, you could use an add on like Float for a more detailed picture. As well as cash flow forecasting, Float offers a number of insights features to complement your forecast and help you identify any issues before they become a major problem.

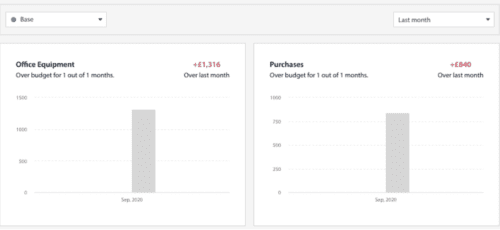

For example, the budget vs actuals report in Float (example above) will help you see at a glance if you are spending more than you’d planned in any specific area.

And the accounts to watch feature will highlight where you are spending over budget most significantly. By surfacing this information for you, Float raises a red flag to any notable fluctuations in budget, which means you don’t have to spend time digging around for this information.

The single account deep-dive view will also allow you to delve deeper into more granular detail on one area of spending – e.g. your utility bills or marketing expenses, for example. So you’ll know exactly where the overspending is occurring and can take swift action to prevent further over expenditure.

With all this information at your fingertips, overspending will no longer become a nasty surprise, but rather something you can nip in the bud before it causes serious cash flow problems. Leaving you to get on with the day to day running of your business.

How to deal with overspending

Once you’ve identified areas of overspending, the next step is to move toward a healthier cash flow by either increasing cash into your business or cutting any unnecessary spending.

If your business is in dire need of a cash injection, then working with an accountant to look at where you can minimise your tax liabilities and getting advice on loans, grants and other business funding could help.

To cut outgoing cash, there are a number of areas you can look at to reduce spend. As we outlined above, there are some common areas in which businesses overspend. Now’s the time to take a good look at them to see whether you can scale back:

Office space

Do you really need a plush office in that trendy postcode? With more businesses going remote due to the pandemic, it could be time to rethink what office space you actually need.

Staff

While many businesses are desperately trying to retain as many employees as possible, you may want to consider outsourcing any new work that comes up, instead of hiring permanent staff for the time being.

Insurance and utility bills

When was the last time you shopped around to find the best deal on your insurance or energy bills? Even calling up your existing suppliers can often result in a better deal and ease the financial burden on your business.

Subscriptions

Many businesses have subscriptions ticking along for products or services they no longer use. Now is the perfect time to review which ones you need and cancel those you don’t.

To help you identify exactly where you need to cut spending, you can use Float to review spending over the past 3-6 months and pinpoint areas for improvement.

Chris Davies, owner of Dog And Pony Studios an international creative agency, told us:

“When I click a tab in Float I see exactly what’s going on in my business, with detailed insights. I can see which invoices have been paid and which are overdue. Instead of waiting for my end of year accounts to see where we spent money, I can see it monthly or even weekly. I’ve been able to make decisions on operating expenses on a per-case basis, such as switching internet, hosting and insurance, because of how granular Float is. The money I’ve saved has been put towards financing current work-in-progress, but occasionally it becomes my dividend.”

You can read more about their Float journey here.

Want to try Float out? Get a free 14-day trial and banish overspending for good.