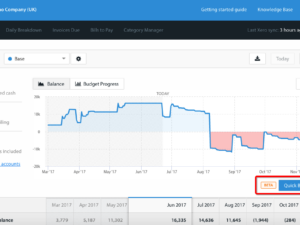

Cash flow problems can occur for any business. Whether you’re growing, just starting out, or running an established business, it’s not always smooth sailing. In fact, 82% of businesses become insolvent because of bad cash flow, which isn’t all that reassuring. But don’t worry, we’ve got your back. That’s why we’ve written this guide to […]