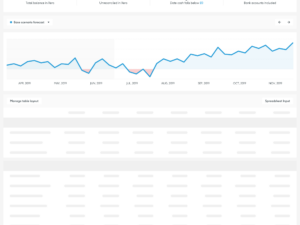

Getting a strong handle on how much cash is coming into your business is essential to making informed decisions for your business. Right now, it can be hard to predict what money is going to come into your business and when. The current situation is constantly changing and the uncertainty is inevitably causing many business […]