Back in 2019, on the first day of Xerocon Brisbane, Chief Product & Partner Officer and all-round Xero rockstar, Anna Curzon, announced the arrival of Xero’s new cash flow pilot.

Now, Business Snapshot has officially launched and offers Xero users “a dashboard-style report displaying performance measures to help you understand your organisation’s financial position”. This short-term cash flow pilot provides Xero users with a 30-day view of the operational health of their business.

Here’s what Anna Curzon explained about the pilot:

[embedyt] https://www.youtube.com/watch?v=eS_GI1gtCUA[/embedyt]

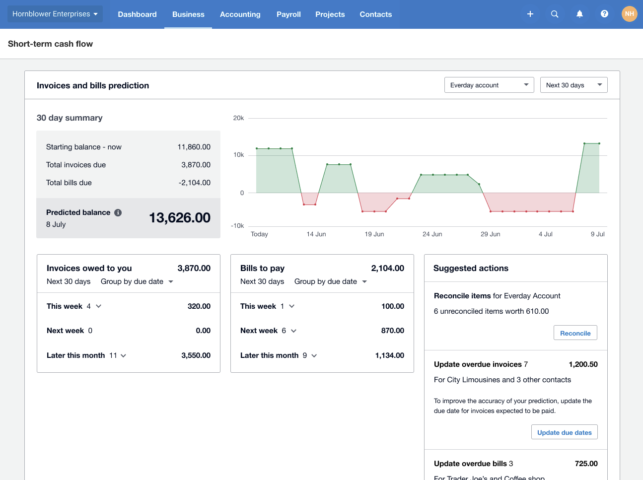

Here’s what the feature looks like:

How does Business Snapshot work?

Xero’s Business Snapshot cash flow pilot measures the impact of existing bills and invoices already in the software, and presents a visual insight into the peaks and troughs for up to 30 days ahead.

This kind of insight can allow small businesses and their advisors to keep their eye on their cash flow, and will allow some scope for forewarning before they dip into the red.

At Float, we know that cash flow is the lifeblood of a business. In fact, it’s what we’re all about. And with Xero’s new cash flow pilot, we’re excited to see it whet the appetite of accountants and small business clients to get a deeper understanding of where their business is, and where it could be.

What more can be done to understand cash flow?

It’s fantastic to see Xero taking cash flow monitoring so seriously. This tool can give businesses a great understanding of their upcoming bank balance based solely on invoices and bills already in the system. But if you’d like a bit more flexibility and functionality, there are many more cash flow apps in the Xero app marketplace that can help you.

So what can Float add on top of Xero’s Business Snapshot?

- Granular insights into cash flow, up to three years ahead (Xero’s goes up to 30 days)

- Float allows you to set cash budgets for items that aren’t represented by an invoice or bill

- Daily import of invoices, bills and transactions to populate cash expectations with reality

- Easily create multiple different, visual scenarios to plan for the ‘what ifs’ – see what would happen if you lost a client or hired new staff, for example

- Insights and reports to compare budget vs actuals

- Explore the effect of expected payment dates on invoices and bills

- Split invoice payments into payment schedules to suit the business

This video explains how Float can help your business:

To understand more about how we do cash flow, and how we work alongside Xero to make it more accessible to yourself and your clients, check out our Xero page.

We’re so delighted to see Xero moving in this direction. We’d love to hear what you think of the pilot, and we look forward to working with Xero to bring cash flow awareness to small businesses around the world.