Sometimes as a company it’s frustrating not to be able to solve everyone’s problems 100% of the time. But there are also moments when we’re immensely proud of what we’re building as a team and excited about what it means for our customers. Over the past year we’ve been rebuilding Float from the ground up. What primarily started as an “under the hood” performance update turned into a completely updated interface. Over a few months we’ve been beta testing it and responding to feedback. With that in mind I’m very excited to introduce you to the new Float!

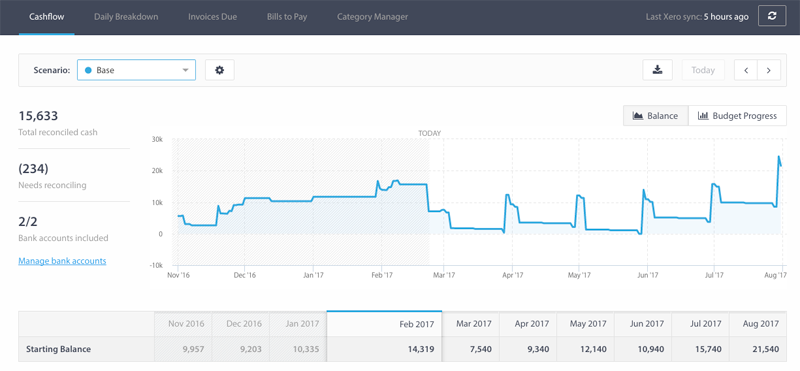

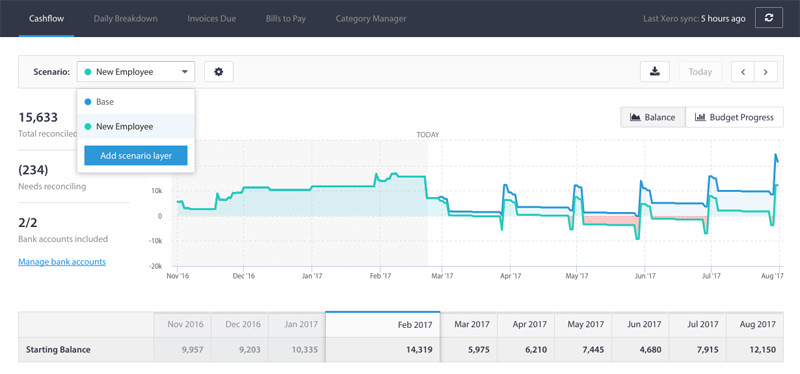

Cashflow Graph

The cash flow graph has been redesigned, making it much quicker to move forwards and backwards on both the graph and the table using the arrows at the top. You’ll see your total reconciled (or matched) cash balance at the left hand side. And you can manage your bank accounts and credit cards below.

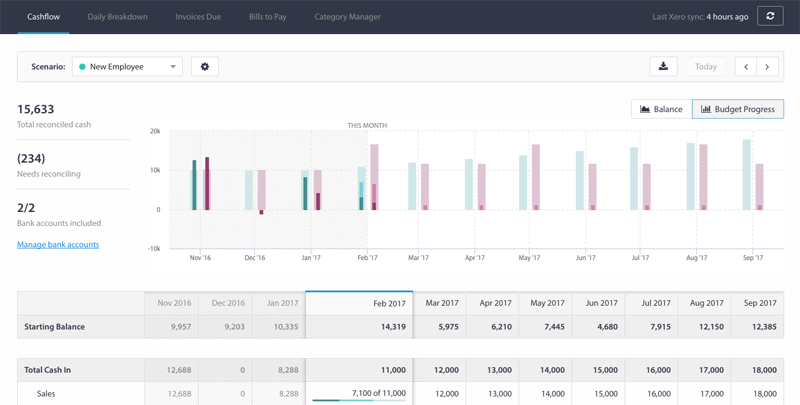

Budget Progress

Now you’ll find the budget progress bars under their own view called ‘budget progress’, showing you how your actuals (dark red and green), upcoming invoices and bills (middle red and green) compare with your overall budgets (lighter outlines). This will help you see how accurate your budgeting is month by month, enabling you to identify when you might need to adjust your forecasts.

Cashflow Table

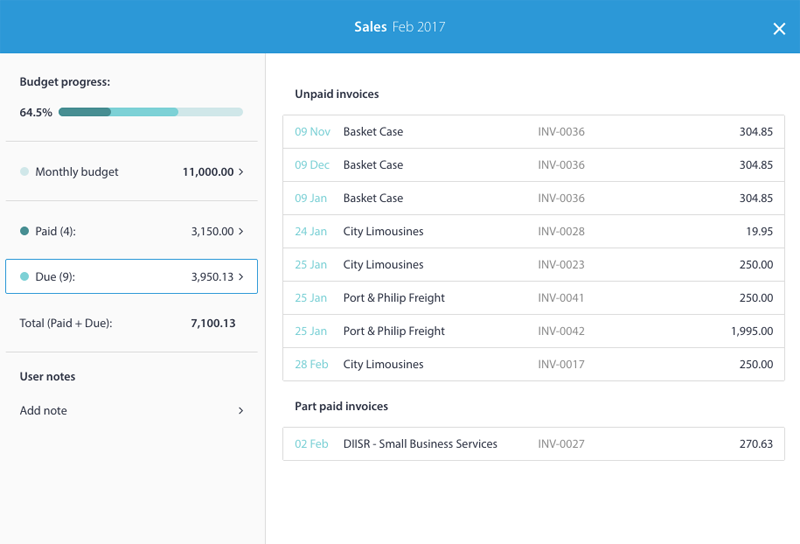

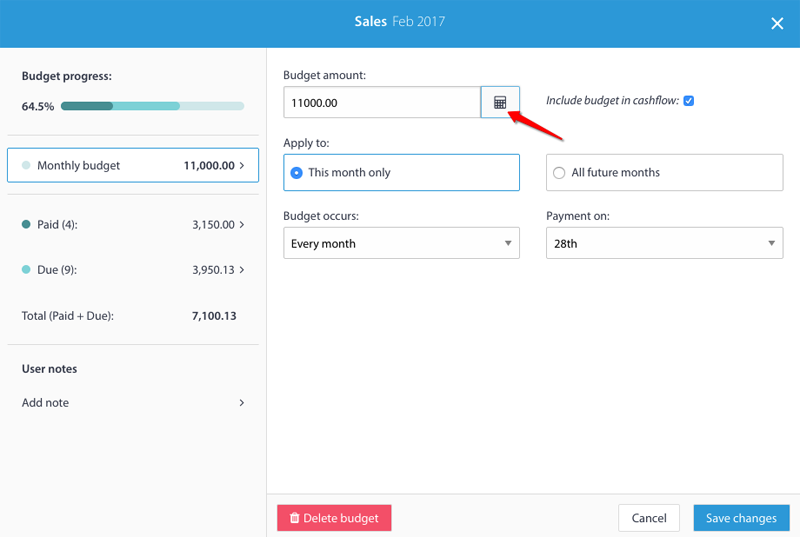

In the table below, there is a new pop up window to enter budgets. Now you can set your budgets on the first screen, and they can repeat monthly, weekly, or every other week. Having more space to work with will allow for more functionality on areas like annual and quarterly budgets, which are coming soon.

In the new Float, you can now get a 3 month average budget by simply clicking into the current month and then clicking on the calculator to the right of the budget box.

You can also see your paid and due bills and invoices down the left hand side, as well as your percentage progress at the top left.

On the table itself you’ll find simplified sections – ‘cash in’ and ‘cash out’. If you’d like to group things together, you can do that in ‘Category Manager’.

Scenarios

Here you can create new scenarios. Now you just have to ‘add a scenario layer’. This adds a new scenario layer on top of your Base (or official) forecast. You can also bring through your Xero or QBO budget here as your ‘base’ if you like.

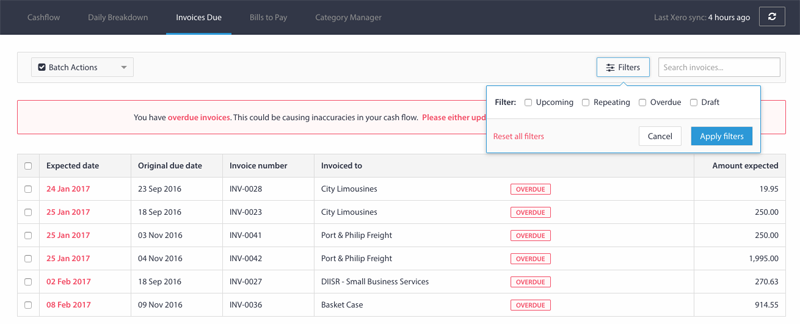

Invoices due and bills to pay

Cash Manager has been extended to two tabs – invoices due and bills to pay. Now you will be alerted on this screen if you have overdue bills or invoices, as these affect your cash flow because Float assumes they will be payable on today’s date. To change their expected date, click on the date to make the change.

You can also select multiple bills or invoices and exclude them from your cashflow if you like. And you can filter your invoices or bills at the top right.

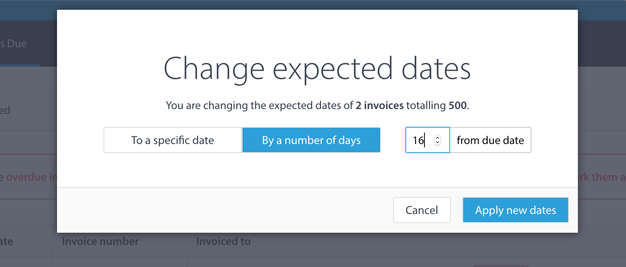

Change expected payment dates by number of days

One of the most important parts of creating an accurate cash flow forecast in Float is managing the expected payment dates on your invoices and bills. We’ve now made that much easier, giving you the option to extend one or multiple invoice or bill expected dates by a set number of days.

So for example, if a particular client has net 60 day payment terms and their invoices are due in 30 days, you can search for the invoices just for that client, select them, and extend them all by 30 days from their due date. No more faffing around with individual invoices!

We’re really excited about this release as it lays the foundation of some very exciting improvements to come on the new Float. You can expect a lot of enhancements over the coming months.

Are you on the previous interface and would like to upgrade for free? Just email support@floatapp.com.