More importantly, what does it mean for your agency?

- Save piles of cash under the mattress?

- Convert it into coins and swim around in it all day?

Let’s dig into what “cash is king” means for your business, and the benefits of cash flow forecasting for agencies.

I got 99 problems

An agency owner once told me: “Cash flow is the least of my worries”.

They were very successful, regularly invited to pitch for large pieces of work and had a great track record of delivering. They also had a significant portion of their work in the form of retainers for digital development.

Sadly this does not represent the majority of service-based businesses out there. In addition, the world is changing. As we enter a downturn in the economy, many clients are moving away from wanting long-term retainers. Existing clients will be cutting budgets and paring back spend.

This means…new clients are vital to the growth of your business.

What’s that got to do with cash flow?

Let’s say there are three primary ways you can win new business.

- You can hope that new work will come in from referrals.

- Pray for the phone to ring and maybe attend some networking events.

- Invest in sales and marketing activities.

If you pick the 3rd option, the next question you need to answer is: How much time, money and resources are available? This is where a rolling cash flow forecast becomes crucial.

What the heck is a ‘rolling cash flow forecast’ – and how will it help me?

Maybe you had a monthly marketing budget assigned at the beginning of the year, or maybe you didn’t. Investing in growth isn’t just a one-off thing. Ideally, it’s a regular cost planned as part of your budget. Plenty of agencies have nothing set aside for this. You might decide on 10% of your expected annual revenue.

Let’s say you’re hoping to turn over 250k this year. That would give you 25k to invest. Let’s call it 2k per month. Maybe that is already allocated to a mix of SEO, Ads and PR or copywriting. Maybe you want to do more, pause that or reallocate it.

What can you do?

- You could hire a consultant to work on a project.

- You could take on a junior marketing hire to help you action your ideas consistently.

- You could hire a fractional CMO or coach to help you implement a new strategy.

The key question with all of these activities is: Can we afford it? And when you say “Can we afford it?” essentially it’s a question about cash flow and timing.

- How confident are we in our sales pipeline?

- What else is happening in the business that we’ve committed to already?

- What tax liabilities are due to be paid?

- What are our fixed costs that are unavoidable?

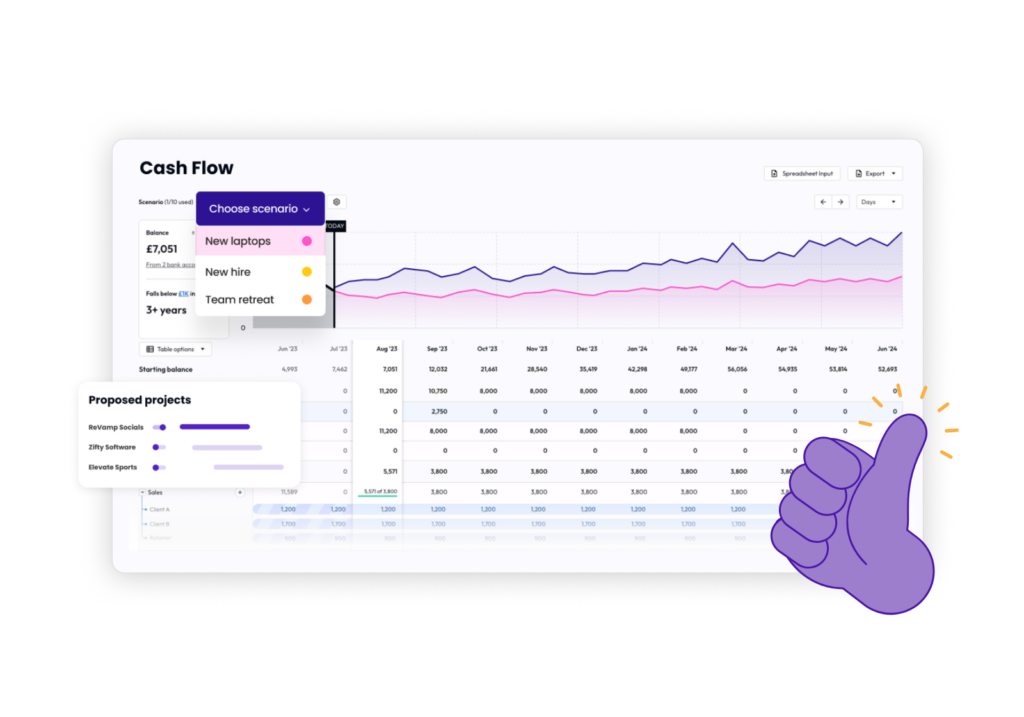

A rolling cash flow will allow you to see the impact of these events and make a decision more confidently on what you can afford to invest.

“You need to know how to time the investment, and make sure it doesn’t collide with dips in sales, tax payments, other unavoidable commitments or one-off costs.“

So how can we invest in growth if we’ve got lumpy cash flow?

Having a cash flow like the one above allows you to make sure what is required and what needs to happen to make sure cash doesn’t go into the negative, and prevent you from being unable to meet your obligations.

A rolling cashflow forecast might seem like a luxury or a nice to have, but if you’re a growing agency with a significant amount of income that’s lumpy and sales that are hard to predict – putting this in place now becomes one of the cornerstones of growth, your ability to react quickly, and your ability to have confidence your numbers.

“Putting this in place now becomes one of the cornerstones of growth, your ability to react quickly, and your ability to have confidence in your numbers.”

How to establish the rolling cash flow forecast

What work is required to maintain a great financial system with a regular rolling cash flow forecast?

- Up-to-date bookkeeping. Find a bookkeeper who can reconcile your books daily or a few times per week.

- A way of capturing all your bills, invoices and expenses digitally. This will make the bookkeeping so much easier.

- A monthly close process. When you have both steps above in place – doing a monthly close – where you essentially check off all the reporting required to report on how the month went.

- A monthly check on the costs in the cash flow forecast. Looking ahead go over any regular payments or budgets that you’ve set and review.

- A regular update on invoices and bills’ expected payment dates. Doing this within your cash flow allows you to see the impact immediately.

It’s a bit of work and involves a process. But it’s a system that once established will allow you to fuel your growth, and not get caught out when it comes to investing in that growth. So while an up-to-date rolling forecast might feel like a ‘nice to have’ right now, this one will bite you the hardest if you’re unaware of it.

Not being in a position to make the payroll or pay your taxes is one of the most stressful things that can happen to a small business owner. Managing and projecting cash is a process for growth and peace of mind.

Follow us for more content about building the systems that will help grow your agency with confidence.