How much thought have you given to short term or long term cash flow forecasting recently? Most business owners know they should have a cash flow projection. But with the pressures of getting a business back up and running as lockdowns ease, prioritising cash flow is easier said than done.

However, with Xero recently reporting that late payments to small businesses increased by 7.8 days between February and May this year and a 28% drop in small business revenue – there’s never been a better time to get on top of your cash flow than right now.

Cash flow forecasting is an essential tool to have under your belt, as a solid forecast will alert you to any cash shortfalls and give you the information you need to make swift remedial action.

There are different types of cash flow forecasting techniques, such as the direct or indirect methods, which look at cash from operating activities. The former is based on actuals and can help you create powerful short term cash flow forecasts, whereas the indirect method is less accurate, but can help with long term forecasts.

While both types of forecast are important, at the moment businesses should be focusing on short term cash forecasting to help guide them through the next few months.

Create a short term cash flow forecast

Building a short term cash flow forecast can be complex, but it’s essential to help you understand your current and upcoming cash position.

A short term cash flow forecast can be defined as anything from a one week forecast, to 30 days, 60 days, or even 90 days into the future. Looking at the immediate future will give you more confidence to make decisions about your business as your customers emerge from lockdown.

Start with short term money in

When building your short term cash forecast, ask yourself: how is money going to come into your business over the next few weeks and months? Are you likely to be making sales? Or are you waiting for invoices to be paid? When is this money actually going to hit your bank account?

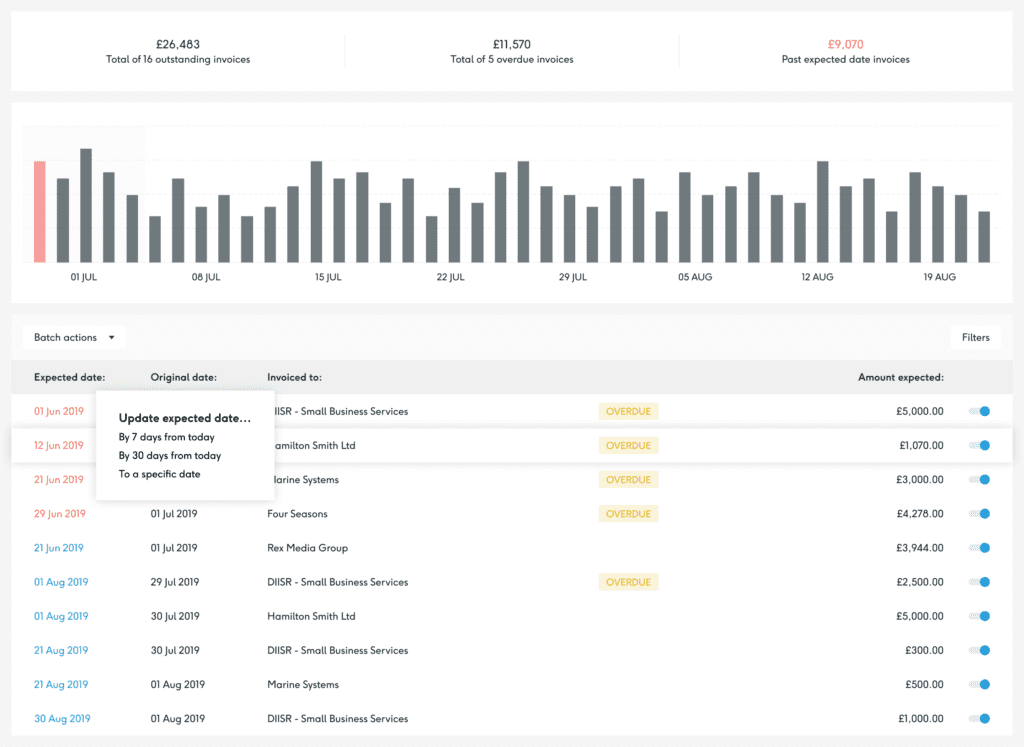

Remember the due date on your invoices isn’t necessarily the date you can expect to see the cash – so don’t become dependent on the date your invoices are marked as due. In Float you can update this to an expected payment date, so it more accurately reflects when an invoice will be paid. Late payments have always been an issue for businesses, and now more than ever you need to be conscious of these delayed payments.

Some businesses have incoming cash that isn’t invoiced, this type of cash could come in as a direct debit or credit card payment. This is common in retail, hospitality and ecommerce businesses. If this is the case for your business, remember to add these incoming payments to your short term forecast too.

In normal circumstances, we’d recommend you create your short term cash flow forecast with predictions based on previous sales (for example, in Float you can take a 3 month average of a past budget for this) however, these are not normal circumstances. For that reason we’d recommend you keep your predicted sales fairly conservative and review regularly based on how much money your business is making on a weekly basis. Logging into Float once a week will keep your forecast up to date and help you move forward with as much confidence as possible in these unpredictable times.

Add in short term money out

Once you have a handle on what money is coming into your business in the short term, it’s time to also look at what you’ll be paying out.

Using Float, your short term forecast will be based on actual money in the bank. Bills from suppliers will be automatically pulled through to Float from your accounting software (Xero, FreeAgent or Quickbooks) and will be factored into your forecast.

However, you’ll also want to set budgets to show regular money going out of your business that doesn’t come from a bill. These are payments such as rent, salaries, recurring direct debits and tax. Regular key cash movements can have a significant impact on your forecast, so it’s important to set aside some time to make sure these budgets are as accurate as possible.

If you’re an existing user of Float, you’ll already have these budgets set up. In this case, you just need to log in and check that all of your planned outgoings are still up to date. You can update your existing budgets at the click of a button, and instantly see the impact on your cash position.

For new users, setting budgets is a relatively simple and straightforward process and within Float you’ll find suggestions for each budget based on past actuals – but, of course, you can add your own too. We understand how important it is to get really granular with some budgets, so Float gives you the option to increase or decrease budgets by a percentage or a certain amount over a set period. This is likely to be a handy tool for businesses looking to rebuild after lockdown. For example, you may want to increase your budget for salaries monthly as you gradually bring staff back from furlough.

Build a long term cash flow forecast

In addition to your short term cash forecast, it’s important to keep one eye to the future. You can do this with a long term cash flow forecast.

So, how long exactly is a long term cash flow forecast? In theory, it can be as long as you like, but we recommend you forecast at least 12 months in advance. In Float you can forecast your cash for up to 3 years, which is particularly useful if you have plans for expansion or to move to new premises. Longer term cash flow forecasting requires less frequent input, so checking in on your long term forecast once a month is ideal.

While your short term forecast examines the nitty gritty, your long term forecast helps you answer the big questions about the future of your business. Think of short term as a detailed map and long term as the bird’s eye view of your path ahead.

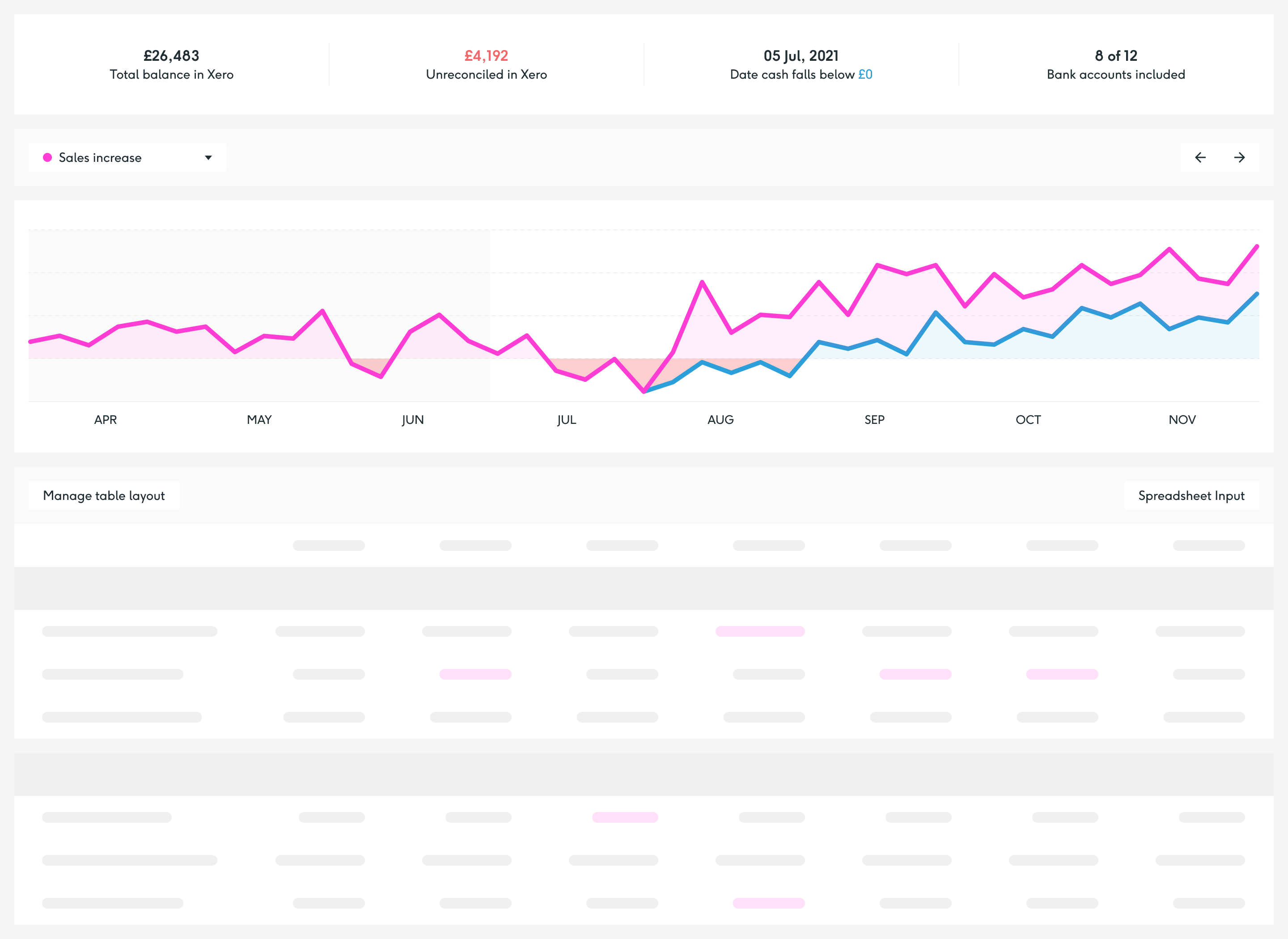

Long term cash flow forecasting really comes to the fore when it comes to making business decisions. You can use scenario planning to review potential ‘what if’ scenarios. From strategic direction to budgeting and planning, a long term cash flow forecast will help you decide where you want to be in one, two or three years’ time – and, importantly, what you need to do to get there.

Look at long term money in

Looking long term, you’ll want to consider payments coming in relating to investments, funding and hedge maturities. You should also include projections from your sales and finance teams. When planning long term cash flow you’ll also want to consider seasonality and look at your historical records to see if your business tends to experience peaks and troughs in cash flow – a common trend in tourism and hospitality businesses.

Consider long term money out

With many businesses currently taking advantage of government support to get through the coronavirus pandemic, it’s important to factor in repayments of loans you’ve taken out to get through this critical time. If loan repayments don’t kick in for 12 months, you may feel you don’t need to think about this expense immediately. But having factored this into next year’s forecast will give you a head start thinking about how you’re going to repay it. Trust us, your future self will thank you for this.

Long term and short term cash flow forecasts have historically been made in spreadsheets and still can be. However dealing with such vast quantities of data in a spreadsheet can be cumbersome and often rather confusing, which is exactly why we created Float. By using Float cash flow forecasting software you can take the stress out of creating your short and long term cash flow forecasts, save time, and get an accurate, always up to date picture of the state of your business.

Long term and short term forecasting is vital to help your business thrive now, and in the future. So start forecasting today.

Further reading:

https://floatapp.com/blog/long-term-cash-flow-forecasting-habit/