If you are one of the many businesses that relies on spreadsheets to produce cash flow forecasts, you may have had occasional doubts and concerns about the level of accuracy and time it takes to produce them. You’d be right to question them.

The fact is that a whopping 88% of spreadsheets contain errors*. One slip with a zero or decimal point could completely throw off your whole forecast, and potentially have a serious impact on business decisions.

The good news is that Float lets you pull your data instead of your hair. By extracting data straight from your accounting software, it means that if it’s correct there, it will be correct in Float.

Escaping manual data entry

Our customers report that preparing cash flow forecasting manually takes them between 3 – 8 hours a month! We think this time would be better spent on doing what they do best – running their businesses. Due to Float’s automatic updates this time can be cut in half, or less. That’s more time for customers – or more time for sleep!

Easy to use

Float’s beautifully simple interface is a breeze to use in comparison to a complex spreadsheet. We take out the accounting jargon that comes with other tools on the market, leaving no barriers to easily understanding the future cash position of your business.

“Simple and intuitive and really helps you get to grips with your cashflow. If you are fiddling around in a spreadsheet: stop and use this instead.” – Keith Reed, DevicePilot

Stay up-to-date with actuals

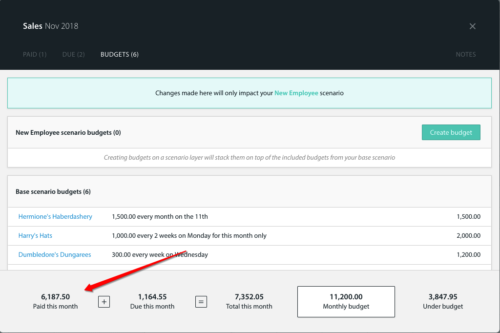

One of the main problems with spreadsheets is that they don’t stay up to date with incoming or outgoing cash, whereas Float updates your budgets with your actual in-goings and outgoings as the month progresses. Just click into any cell to see your progress towards (or beyond) a budget.

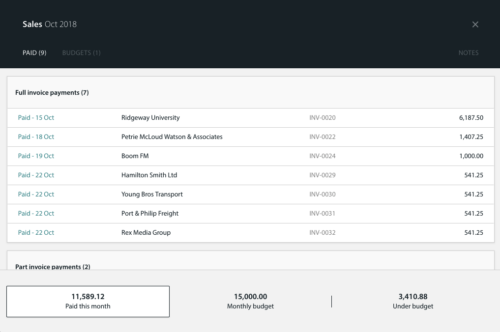

See the detail behind a number

With a spreadsheet, a number in a cell is just that. You don’t know what that number is made up of, but with Float you do. Just a click into a cell allows you to see all the transactions, bills and invoices that make up a number. You can also view your budget vs your actual or expected cash in and out at any time.

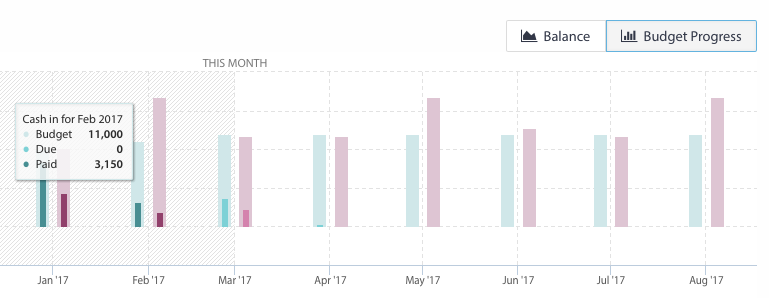

See it all clearly

Float’s interface visualises your future cash position in a way that is very difficult to achieve with a spreadsheet. You can also export a PDF report of the visual future of your business and send it to anyone you like. How useful is that?

“The integration makes our data light up in a way that Excel spreadsheets can’t.” – Andrew Moore, Lifeloaded

Access it all on any computer

With Float living in the cloud, you and your colleagues or financial advisers can all access Float from wherever you are and collaborate on your forecast. It’s never been easier to share your future plans.

But hey, don’t just take our word for it. Here’s what one of our happy customers has to say:

“Float is awesome, I previously used a spreadsheet for my cash flow forecasting which was high maintenance and inaccurate. Since using Float I have never looked back. I don’t know how anyone can run their business without it!”, Denny O’Halloran, Roofline.

Live-rolling forecast

Every 24 hours, Float automatically imports your accounting data and dynamically updates your starting balance, ensuring that your data does not go out of date. Because of these updates, Float gives you a live, rolling forecast. We understand that getting the right starting balance each day is essential to an accurate forecast.

* According to a study by the University of Hawaii