Whether you are looking for traditional or alternative financing for your business, you could be overwhelmed with your options. Luckily we are here to put the fun into funding and the rad into traditional finance.

So here is a quick breakdown of the types of finance available and when to use them.

Investment finance (also known as equity finance)

What is it?

Selling part of your business to an investor in exchange for sweet sweet cash. You get capital and your investor gets a percentage of your business. Some important points about investment finance: it’s only available to limited companies (as opposed to sole traders or partnerships), you’ll end up owning a smaller share of your business and you may also have to consult your investor before making any business decisions.

When to use it?

Investment finance is well suited to covering development costs and startup losses because you don’t pay it back and you may not be eligible for a loan.

Loan

What is it?

Money you get from a bank to be paid back in an agreed length of time (usually 1-10 years). You will almost certainly pay interest (which can either be fixed or variable).

When to use it?

Loans can be used to purchase inventory and to buy or lease assets such as equipment or vehicles.

BONUS! Check out the UK government’s start up loan scheme for amounts up to £25,000 with a fixed interest rate of 6%.

Grant

What is it?

An amount of money usually awarded (usually by the government) for a specific purpose that will not have to be paid back (score). However the application process can be long and competition for grants can be high. Some grants require you match the funding they give you.

When to use it?

Grants will almost always have to be used for a specific project, such as hiring graduates, training employees or purchasing or replacing equipment.

Overdraft

What is it?

An overdraft is a pre agreed credit facility with your bank allowing you to temporarily spend more money than you have in your account. Overdrafts are short term solutions intended to bridge gaps in your cash flow and you only pay interest on the amount you are overdrawn each day. However, exceeding your overdraft limit can mean paying higher interest rates or fees and can result in the bank bouncing your cheques, so keep this in mind. It’s a good idea to have an overdraft set up as a safety net but have a think about the limit you are setting.

When to use it?

Overdrafts are often used to cover working capital and can be used to fill the period between paying suppliers and receiving payment from customers.

Top tips on using traditional finance for your business

- Work out how much you need and when you will need it

- Arrange all your finance at the same time, in advance

- Allow for contingency funding to cover the unexpected

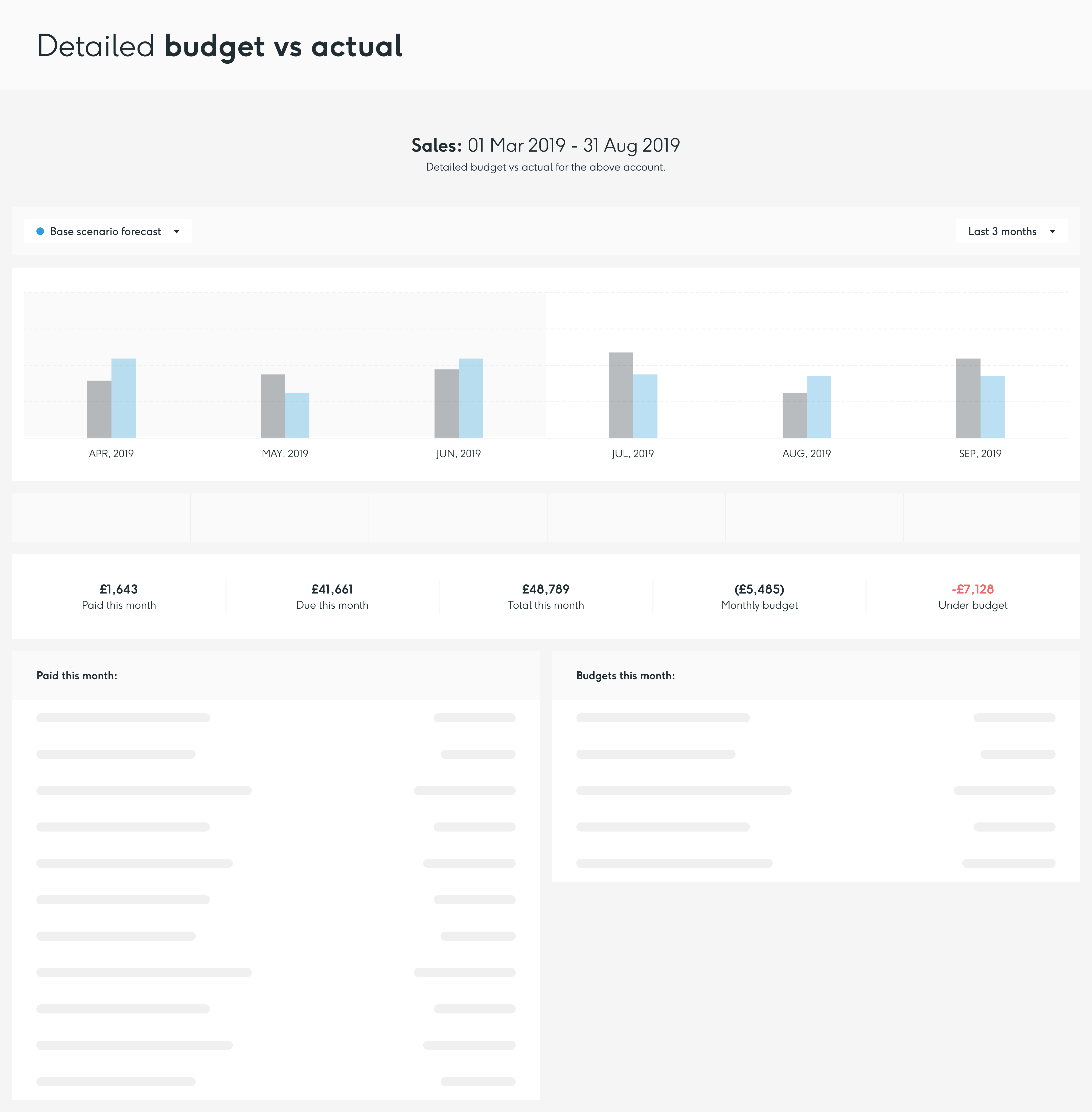

How to know when you will have a cash gap

Are you looking to forecast when you might need a cash injection? Check out Float Cash Flow Forecasting!