As a small business, you may be struggling to bridge the cash gap between when you’re paying bills and when you’re receiving money.

Or maybe you’re wanting your business to grow and you’re looking for investment options. Taking on debt is a very common and relatively cheap way of solving some of these problems.

If your business has been impacted by the COVID-19 pandemic, you may be eligible to apply for government-backed loan schemes such as the Recovery Loan Scheme in the UK.

How can a cash flow forecast help my loan application?

Cash flow, the movement of money coming in and out of your business, tells a lender a whole load of information about your business. It gives them an idea of how much will be left over after you’ve paid all of your daily expenses, which is also called your ‘net cash flow’. Your net cash flow is one indicator that signals whether your business is struggling, breaking even or hitting it out of the park.

No matter what kind of lending you’re looking for, it’s likely a cash flow forecast will be an important part of your application. Before you run away with it, we recommend checking that your lender allows the submission of a cash flow forecast as part of your application.

How to use a forecast to apply for your loan

1. Start with an accurate forecast

Make sure you create a cash flow forecast that’s realistic. If you’re using Float already, we recommend using your base forecast for this. In this ‘most likely’ situation, include projections you’re fairly sure will happen. Think about what your future bank balance could look like. What’s going to come in and when? Is your business seasonal? Are there any large upcoming one-offs? No matter what it’s for, if you’re expecting cash in or out, it should be included in your forecast. If you’ve never done cash flow forecasting before and you’re not sure where to start, have a look at what happened last year or in the last few months and take these into account when creating your forecast.

Update these figures every time your expectations change so that you’re never running completely blindfolded. This can be a difficult exercise and it’s all estimates and projections but the closer it gets to today’s date, the more accurate it should be. If there are other people in your organisation that know different bits of key information, involve them in the process.

2. Work out how much you need

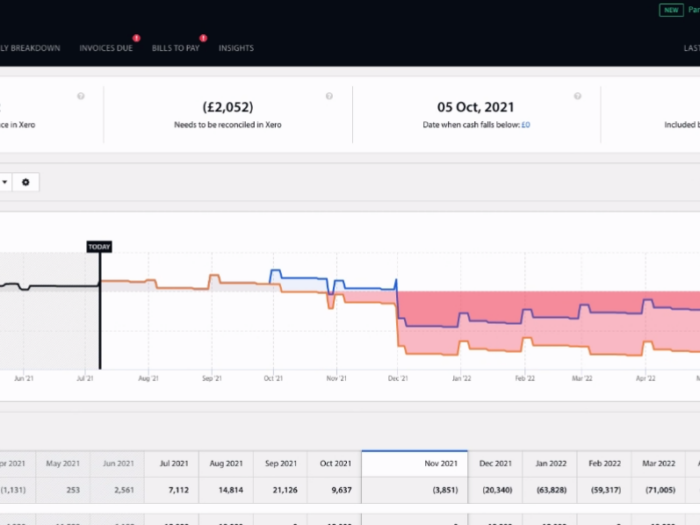

Then, include the amount of debt you’re hoping to take on. If you’re using Float already, add a scenario layer for this using the scenario planning tool. This should quickly tell you and the lender whether what you’re asking for is the right amount and that your business can afford it. If it looks like you’re still running at a negative net cash position despite the extra loan income, you may have to rethink your application or consider different funding options. Remember to include potential, realistic interest and capital repayments as cash-outflows in the same scenario!

3. Create multiple forecasts

The lender wants to know what your ‘best case’ scenario could look like and, arguably more important, what your ‘worst case’ scenario could be. The lender will probably be much more interested in the worst case scenario, as they are constantly considering risk. If your forecasts are conservative and clearly take into account everything that could possibly go wrong and you can still prove that your business will be able to repay the loan, this could really help your application.

If your forecast shows that you’re expecting to have a ‘positive’ net cash position, it indicates that your business could successfully handle taking on debt. Positive net cash flow also gives the lender an indication that your business is growing, as you’ve got spare cash to reinvest into your business. In this situation, preparing a cash flow forecast may help you negotiate more favourable lending terms.

In Float you can export your cash flow forecast to a PDF to attach to your loan application. This will give your potential lender a clear, concise view of your cash projections that’s easy to understand at a glance. Here’s a quick video on how to get that download in Float…

Regardless of what cash position you’re currently sitting at, a cash flow forecast can indicate to a lender that you’re prepared, in control and, most importantly, can repay everything you’ll owe.

Create your own cash flow forecast in Float today, with a 14-day free trial.

Further reading: