To make sure your business grows and flourishes, you have to understand: how much money you need to operate, where there might be cash gaps in the future, and how long you’ll be able to survive without any new capital flowing into the business. And that’s where a cash runway comes in.

What is a cash runway?

A cash runway, in financial terms, is the amount of time a business can stay afloat without extra capital. So if you have £100,000 in the bank, and you need £10,000 per month to run your business, you’d be able to continue operating as normal for 10 months without raising any additional cash. That’s your cash runway. After 10 months though, you’d reach the end of your cash runway and would have to bring some extra cash into the business – fast – to continue running the business.

Why is a cash runway important?

Knowing your cash runway is important for various reasons. Firstly, and most obviously, it ensures that you know where your business is at, and how long it could survive should the worst happen (like a global pandemic) and you’re left without any income for a while. Although it can be scary, and perhaps sobering, to see your finances laid out in black and white this way, it’s the first step to making sure you don’t overspend. It allows you to know in advance when you need to start seeking funding rather than leaving it until it’s too late.

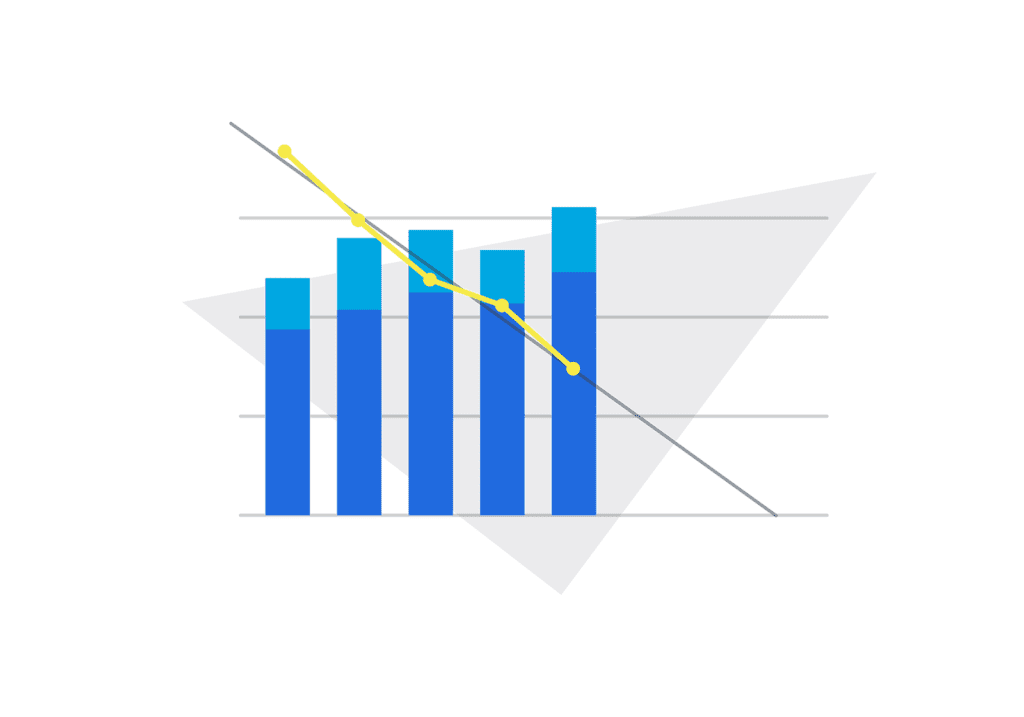

Even without a crisis looming, knowing your cash runway can help you to understand your business’s financial situation. If you see that your cash runway is getting smaller it’s an early warning sign that the business is spending more than it should, and it’s time to take action, whether that’s cutting down on spending, generating new revenue, or seeking funding.

How to work out your cash runway

The most common way to work out your cash runway is by using your burn rate. That is, the amount your business is spending (or burning through) each month. You should first work out your gross burn rate, which is the total amount you spend each month on fixed expenses like rent and utilities plus the total sum of variable expenses such as salaries, supplies, travel and so on.

Then, look at what cash is coming into the business every month – and that means actual cash received, rather than invoices sent. Then, subtract your gross burn rate from the total cash received to get your net burn rate, commonly just referred to as ‘burn rate’.

To work out your cash runway then, you simply divide your cash balance by your burn rate. So going back to that original example, if you have £100,000 total cash, and spend £10,000 every month, then your cash runway is £100,000/10,000 = 10 months. In this instance, you’d have a cash runway of 10 months of normal operations before you ran out of money.

Understanding your cash runway with a cash flow forecast

It’s easier to work out your cash runway if you have an up-to-date cash flow forecast. Cash flow forecasting is especially important to start-up businesses, particularly during periods of fast-paced growth and decision making.

Cash flow is the total amount of money that’s coming in and out of a business at any given time. Naturally the amount of cash your business has ebbs and flows, which is why it’s even more important to keep on top of it – you don’t want to make the mistake of assuming that, because your profit and loss budget might show that you’re in the black, your business is profitable. So you need to stay on top of your cash flow to see the full picture of how your business is performing. And when you’re on top of your cash flow, you can quickly and easily calculate your cash runway.

A cash flow forecast helps you to look at all of your incomings and outgoings, helping your business see how much money it needs to operate – and where you might need to raise additional funds through funding rounds or loans. You can use a cash flow tool like Float to predict cash gaps before they happen – something that’s particularly important for start-ups as you’ll be able to see how long your money will last for, when you’re going to break even, and when you’ll have enough spare cash in the bank to start hiring, investing and growing your business.

Rather than trying to talk through burn rates and cash runways to potential investors, you can simply show them easy-to-understand cash flow graphs from Float to help them understand in exactly which direction your business is heading. The visuals are based on real-time data from your connected accounting platforms (Xero or QuickBooks) and not only helps you to spot any potential problems with your cash runway, but also allows investors a thorough overview of your profitability.

Understanding your start-up business’s cash runway is one of the most powerful insights you can have to help you make important growth decisions. While a cash runway may be constantly moving, a cash flow forecast will help you always know where you stand.

Want to try Float out? Get a free 14-day trial and start getting to grips with your cash runway today.